About Us

About Us

Prior to the enactment of the Pension Reform Act 2004, pension schemes in Nigeria had been bedevilled by many problems. The Public Service operated an unfunded Defined Benefits Scheme and the payment of retirement benefits were budgeted annually. The annual budgetary allocation for pension was often one of the most vulnerable items in budget implementation in the light of resource constraints. In many cases, even where budgetary provisions were made, inadequate and untimely release of funds resulted in delays and accumulation of arrears of payment of pension rights. It was obvious therefore that the Defined Benefits Scheme could not be sustained.

In the private sector on the other hand, many employees were not covered by the pension schemes put in place by their employers and many of these schemes were not funded. Besides, where the schemes were funded, the management of the pension funds was full of malpractices between the fund managers and the Trustees of the pension funds.

This scenario necessitated a re-think of pension administration in Nigeria by the administration of President Olusegun Obasanjo. Accordingly, the administration initiated a pension reform in order to address and eliminate the problems associated with pension schemes in the country. The outcome of the reform was the enactment into law of the Pension Reform Act 2004.

Prior to the enactment of the Pension Reform Act 2004, pension schemes in Nigeria had been bedevilled by many problems. The Public Service operated an unfunded Defined Benefits Scheme and the payment of retirement benefits were budgeted annually. The annual budgetary allocation for pension was often one of the most vulnerable items in budget implementation in the light of resource constraints. In many cases, even where budgetary provisions were made, inadequate and untimely release of funds resulted in delays and accumulation of arrears of payment of pension rights. It was obvious therefore that the Defined Benefits Scheme could not be sustained.

In the private sector on the other hand, many employees were not covered by the pension schemes put in place by their employers and many of these schemes were not funded. Besides, where the schemes were funded, the management of the pension funds was full of malpractices between the fund managers and the Trustees of the pension funds.

This scenario necessitated a re-think of pension administration in Nigeria by the administration of President Olusegun Obasanjo. Accordingly, the administration initiated a pension reform in order to address and eliminate the problems associated with pension schemes in the country. The outcome of the reform was the enactment into law of the Pension Reform Act 2004.

After 10 years of implementing the pension reforms in Nigeria, the Pension Reform Act 2014 was signed into law to address the challenges faced in the implementation processes. In addition, new provisions were made to particularly strengthen the powers of the Commission to resolve conflicts in addition to providing stiffer penalties for infractions. The PRA 2014 addressed the issues regarding pensions of political office holders and Professors as well as provided incentives for increasing coverage of the scheme through allowing contributors to use portion of the balances in their retirement savings accounts to make equity contribution towards owning a residential property

The Commission shall have the power to:

- Formulate, direct and oversee the overall policy on pension matters in Nigeria.

- Fix the terms and conditions of service including remuneration of the employees of the Commission.

- Request or call for information from any employer or pension fund administrator or custodian or any other person or institution on matters relating to retirement benefit.

- Charge and collect such fees, levy or penalties, as may be specified by the Commission.

- Establish and acquire offices and other premises for the use of the Commission in such locations as it may deem necessary for the proper performance of its functions under the Act.

- Establish standards, rules and regulations for the management of the pension funds under the Act.

- Investigate any pension fund administrator, custodian or other party involved in the management of pension funds.

- Impose administrative sanctions or fines on erring employers or pension fund administrators or custodians.

- Order the transfer of management or custody of all pension funds or assets being managed by a pension fund administrator or held by a custodian whose licence has been revoked under this Act or subject to insolvency proceedings to another pension fund administrator or custodian, as the case may be.

- Do such other things which in its opinion are necessary to ensure the efficient performance of the functions of the Commission under the Act.

The Pension Reform Act 2004 established the National Pension Commission (PenCom) as the body to regulate, supervise and ensure the effective administration of pension matters in Nigeria.

The functions of the Commission include:

- Regulation and supervision of the Scheme established under the Act.

- Issuance of guidelines for the investment of pension funds.

- Approving, licensing, regulating and supervising pension fund administrators, custodians and other institutions relating to pension matters as the Commission may, from time to time, determine.

- Establishing standards, rules and guidelines for the management of the pension funds under the Act.

- Ensuring the maintenance of a National Data Bank on all pension matters.

- Carrying out public awareness and education on the establishment and management of the Scheme.

- Promoting capacity building and institutional strengthening of pension fund administrators and custodians.

- Receiving and investigating complaints of impropriety levelled against any pension fund administrator, custodian or employer or any of their staff or agents.

- Performing such other duties which, in the opinion of the Commission, are necessary or expedient for the discharge of its functions under the Act.

The main objectives and features of the Pension Reform Act 2004 are:

- To ensure that every person who worked in either the Public Service of the Federation, Federal Capital Territory or Private Sector receives his retirement benefits as and when due;

- To assist individuals by ensuring that they save to cater for their livelihood during old age and thereby reducing old age poverty;

- To ensure that pensioners are not subjected to untold suffering due to inefficient and cumbersome process of pension payment;

- To establish a uniform set of rules, regulations and standards for the administration and payments of retirement benefits for the Public Service of the Federation, Federal Capital Territory and the Private Sector; and

- To stem the growth of outstanding pension liabilities.

The pension reform programme is governed by the key principles of sustainability, safety and security of benefits, transparency, accountability, equity, flexibility, inclusivity, uniformity and practicability.

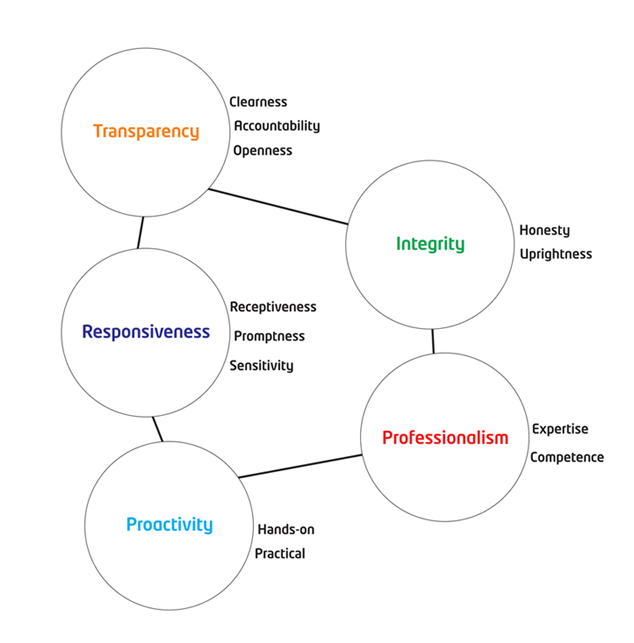

Organization Culture